when are property taxes due in illinois 2019

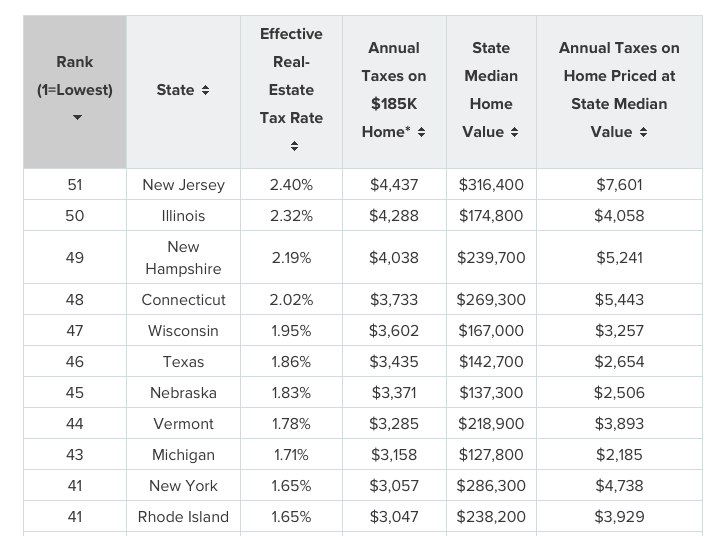

Payments should include the installment coupon numbered 2 from the bottom right-hand portion of the bill. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes.

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Champaign County assessments were sent to the Illinois Department of Revenue for their review in February 2020.

. General Information and Resources - Find information about property assessment and valuation assessment appeals and special assessments as well as links to several helpful resources. County boards may adopt an accelerated billing method by resolution or ordinance. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

Ad A Tax Agent Will Answer in Minutes. Dates in green have been announced the window to appeal is now open Dates in red have passed the window to appeal has closed Dates in gray are estimated based. Learn more about MyDec or to find.

The Official Government Website of Macon County Illinois Search for. Below is a listing of 2019 deadlines for appealing your DuPage County property taxes with the Supervisor of Assessments. REMEMBER TO SET THE TAX YEAR IN THE COLUMN TO THE RIGHT.

Welcome to Madison County Illinois. Monday February 14 through Tuesday March 2 2022 2019 Annual Sale. Tax Year 2020 First Installment Due Date.

A United States Postal Service postmark is accepted as date of payment in the calculation of a late penalty. Tax Year 2020 Second Installment Due Date. In most counties property taxes are paid in two installments usually June 1 and September 1.

12 to give residents extra time to obtain unemployment stimulus checks or other relief. Welcome to Property Taxes and Fees Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. Property Transfer Tax Declarations and MyDec - Real Property Transfer Tax Declarations can now be completed online through the free MyDec program.

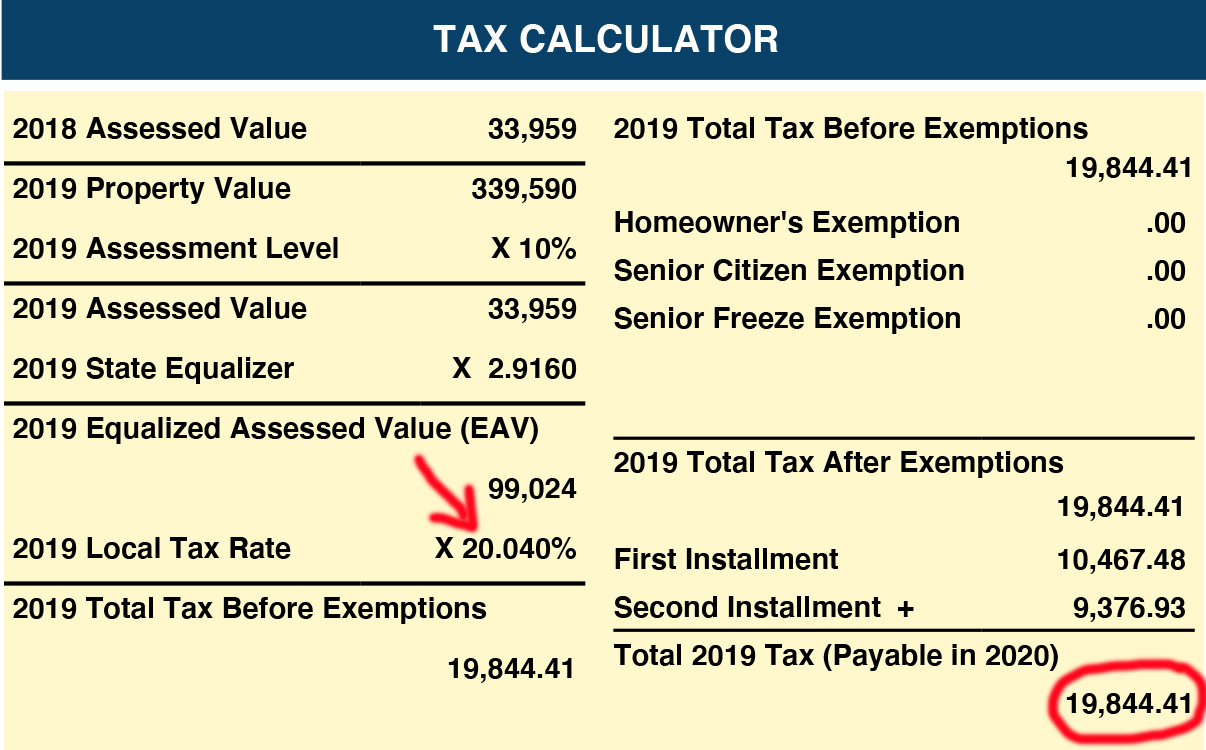

FOR EXAMPLE PAYMENT FOR 2019 TAXES IS DUE IN CALENDAR YEAR 2020. Sangamon County committed to moving due dates on property taxes to June 12 and Sept. 15-Mar-20 When the first installment of 2019 Cook County real estate tax bills recently arrived in property owners mailboxes it included an automatic 2019 first installment estimate based on 55 percent of the 2018 total taxes.

The first installment was due March 3 2020. Property Tax Levy Each year the tax levy process begins in August. In some areas this figure can be upwards of.

The state of Illinois has the second-highest property taxes in the country. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. The April 15 deadline to pay first-quarter Jan.

Questions Answered Every 9 Seconds. You now have until July 15 to make that payment. FOR MOBILE HOMES ONLY SET THE TAX YEAR TO THE CALENDAR YEAR FOR WHICH TAXES ARE DUE.

Ad A Tax Agent Will Answer in Minutes. Mobile Home Delinquent Notices Sent. Tax bills are mailed out in May each year.

However the June 15 deadline for second-quarter April 1 to May 31 estimated taxes is still in place according to Alan Goldenberg a principal at the accounting firm Friedman LLP. To avoid any late penalty the payment must be made on or before June 4th 2021. 1 to March 31 federal taxes has been extended as well.

Tax Year 2021 First Installment Due Date. Amounts are accessible on our website. Voter Election Info.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Tax Lien on Property. 2018 Tax Bills will be mailed May 28 2019.

First Date for Filing a Petition for Tax Deed. Tuesday March 1 2022. Mobile Home 50 Late Penalty Assessed.

This process includes compiling historical data polling townships for growth and reassessment rates developing revenue projections updating the Citys capital plans. The last day to pay the Tax Year 2019 Second Installment before late-payment interest charges was Thursday October 1 2020. All money-saving exemptions such as homeowner and senior exemptions are reflected.

The statewide average effective tax rate is 216 nearly double the national average. Real Estate First Installment Due. Property tax due dates for 2019 taxes payable in 2020.

The typical homeowner in Illinois pays 4527 annually in property taxes. Questions Answered Every 9 Seconds. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a department maintaining webpages within the.

The first installment is due 30 days after the bill is mailed and the second installment is due September 1 unless that falls on a weekend or Labor Day in which case it would be the first working day after that. Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021 Tax Sales 2022 Scavenger Sale. The easiest and fastest way to pay your Cook County Property Tax Bill is online.

For tax year 2019 payable in 2020 all assessments were finalized by July 31 2019 and Board of Review appeals were completed by December 31 2019. Friday October 1 2021. DuPage County Property Tax Appeal Deadlines Due Dates for 2019.

Real estate taxes are billed and collected a year behind. First Installment is due June 28 2019 and second installment is due September 6 2019. The due date for Tax Year 2019 Second Installment was Monday August 3 2020.

Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. TAXES ARE PAYABLE THE CALENDAR YEAR AFTER THE TAX YEAR. Real Estate Property Tax Bills Mailed.

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Dupage County Il Treasurer Sample Tax Bill

The Cook County Property Tax System Cook County Assessor S Office

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Property Tax Prorations Case Escrow

Property Tax City Of Decatur Il

Property Tax City Of Decatur Il

The Cook County Property Tax System Cook County Assessor S Office

Expected 7 5 Billion In Federal Aid Won T Fix Illinois Budget Crisis Without Structural Reforms

Illinois Income Tax Rate And Brackets 2019